Life Insurance in and around Omaha

Life goes on. State Farm can help cover it

Life happens. Don't wait.

Would you like to create a personalized life quote?

Check Out Life Insurance Options With State Farm

It can be a big responsibility to provide for your family, which may include finding the right Life insurance coverage. With a policy from State Farm, you can help ensure that your loved ones can pay off debts and/or maintain a current standard of living as they grieve your loss.

Life goes on. State Farm can help cover it

Life happens. Don't wait.

Why Omaha Chooses State Farm

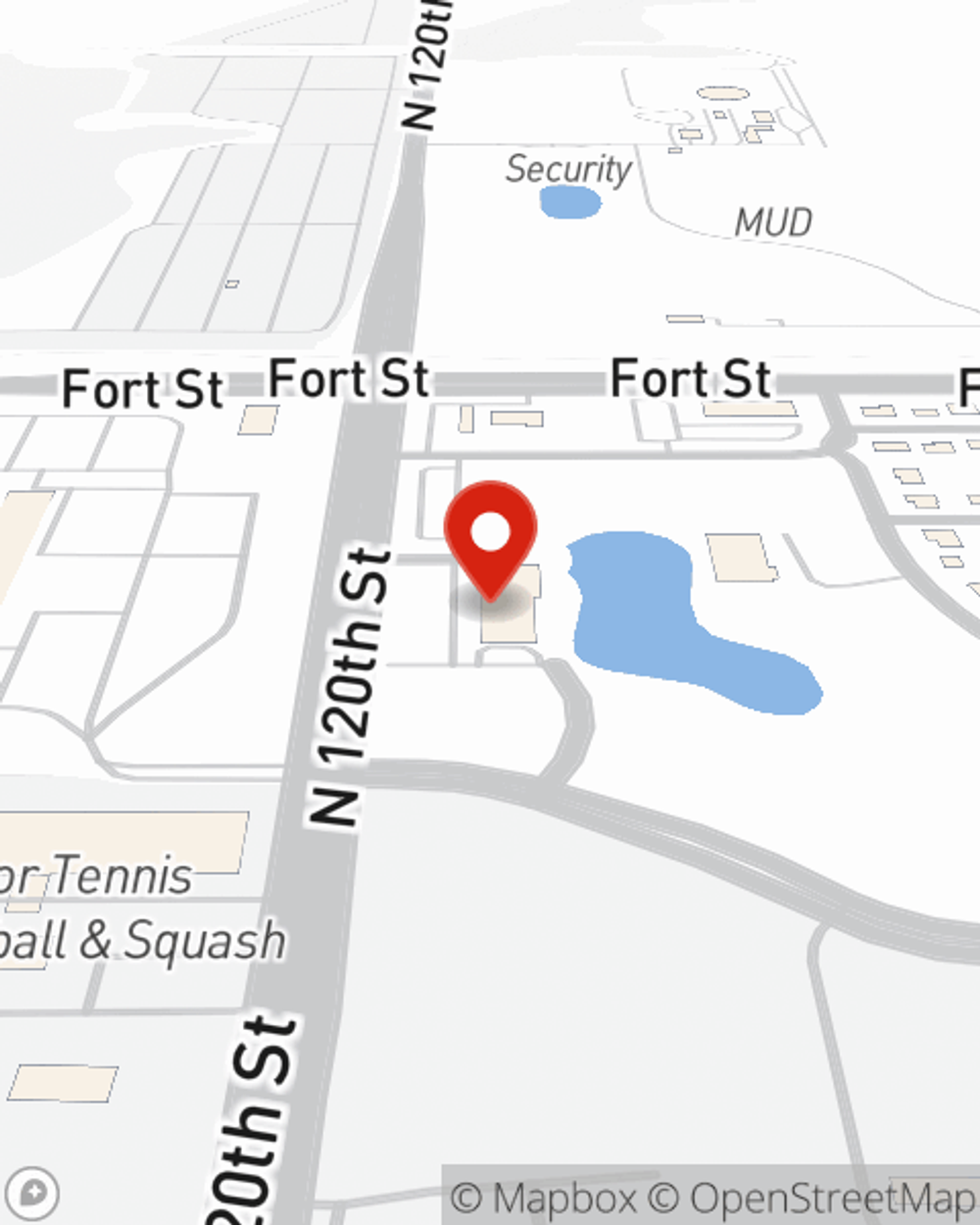

Fortunately, State Farm offers many coverage options that can be modified to fit the needs of those most important to you and their unique situation. Agent Sherman Willis has the deep commitment and service you're looking for to help you purchase coverage which can support your loved ones in the wake of loss.

Simply talk to State Farm agent Sherman Willis's office today to discover how the State Farm brand can help cover your loved ones.

Have More Questions About Life Insurance?

Call Sherman at (402) 493-1000 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

How much life insurance do I need?

How much life insurance do I need?

Here are some of the main factors to consider when you start thinking about the people & assets you want to protect & how long you want to protect them.

Enjoy flexible premiums and protection with Universal Life insurance

Enjoy flexible premiums and protection with Universal Life insurance

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit.

Sherman Willis

State Farm® Insurance AgentSimple Insights®

How much life insurance do I need?

How much life insurance do I need?

Here are some of the main factors to consider when you start thinking about the people & assets you want to protect & how long you want to protect them.

Enjoy flexible premiums and protection with Universal Life insurance

Enjoy flexible premiums and protection with Universal Life insurance

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit.